Medicare Supplement Plans in Georgia

You may be surprised to know that as of October, 2013 there are more than 40 Medicare Supplement Plans in Georgia. The good news is that you don’t have to contact every one of them to find out which one has the best rates in your area. Independent Medicare Supplement Agencies like Southern Senior Care are licensed with some, most or all all of the available plans in Georgia.

Independent Agencies are also equipped with computer programs that enable us to see all of rates for all of the plans in your area. Since Medicare Supplement Plans are regulated by the Centers for Medicare and Medicaid Services, once you have a comprehensive list of plans and rates, the decision of which to go with is usually pretty simple. Here is a partial list of plans currently available in Georgia.

Some of the Medicare Supplement Plans in Georgia

Aetna Life, American Republic Corp, American Retirement Life Ins, Assured Life Association, Bankers Fidelity, BCBS of Georgia, Central States, Christian Fidelity, Combined, Continental Life, Equitable Life, Family Life, Forethought Life, Gerber Life, Globe Life, GPM Life, Heartland National, Humana, Loyal American, Madison National, Manhattan Life, Medico, New Era Life, Omaha Insurance Co., Oxford Life, Physicians Mutual, Royal Neighbors, Standard Life and Acc, State Mutual, Sterling Investors, Sterling Life, Transamerica, United American, United of Omaha, UnitedHealthcare (AARP).

So if you are new to Medicare, turning 65 or loosing group insurance, or just want to compare your current Medicare Supplement rate with those that are available through all of the other companies, just ask your Health Insurance Agent to run a rate comparison for you. If you do not have an Agent who specializes in Medicare, and you live in Georgia, Tennessee, or South Carolina, fill out the Free Rate Comparison form on this site and we will provide you with a complementary rate comparison.

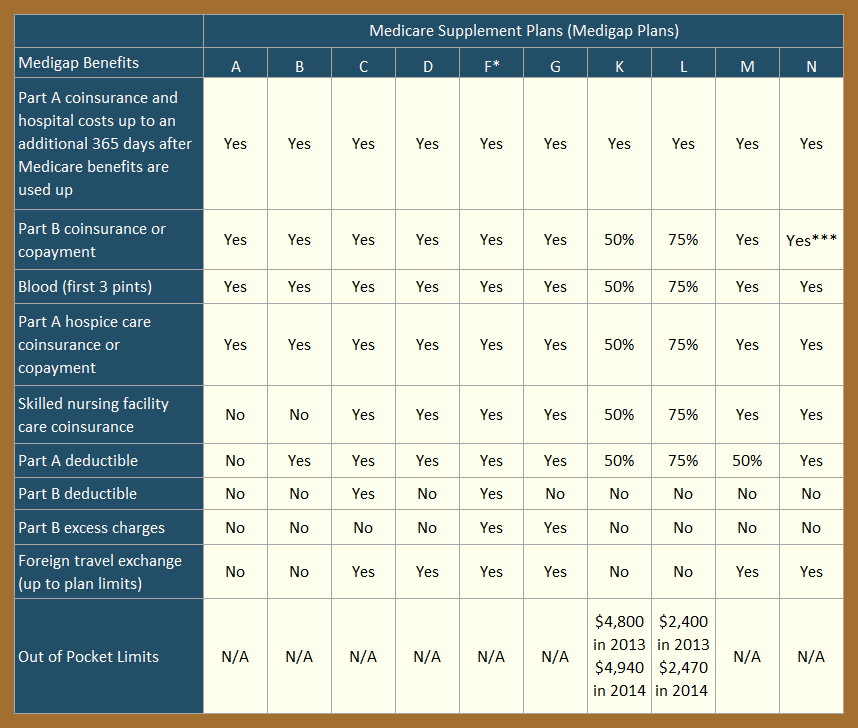

There are currently ten standard Medicare Supplement Plans in Georgia (and the rest of the country). There are also “select” versions of C and F. See the chart below for an overview of what benefits are covered by each plan.

Most companies don’t offer all of the Plans that are available. The most common plans are F, G and N. C and D were common in the 90’s and early 2000’s. And K, L and M do have their fans. It is a personal choice, but once you understand the pros and cons, the decision is usually pretty easy.

{ 0 comments… add one now }