Review and Compare your Medicare Prescription Plan Every Year

Should you change your medicare prescription plan? The correct question to ask is “When should I review my Medicare Prescription Plan?” And the answer to that question is “Every Year.” If you have a Medicare Prescription Plan (also known as a Medicare Part-D plan) you have the option of changing plans each year during Medicare Annual Enrollment, which currently is between October 15th and December 7th. To know if you should consider changing plans, you must first evaluate your options.

How to Compare Medicare Prescription Plans

In most states and counties, there are dozens of Medicare Part-D plans available. It is very easy to evaluate and review the options available to you. There are ways to compare Medicare Part-D plans. Both of these methods are equally as effective since they both use the same data.

Method 1 – Call Medicare

The easiest way is to call Medicare any time during Annual Enrollment and speak with one of the people there. They are available to help you 24 hours a day, seven days a week. The number is 1-800-633-4223 (800-MED-ICAR) – they ignore the E.

Method 2 – Visit www.medicare.gov

If you have an internet-connected computer and are comfortable using websites with forms and web applications, you can do the research yourself. You will be accessing the same data that the Medicare Agents use when you call and speak with them over the phone.

What You Need for your Review of your Medicare Prescription Plan Options

Whether you choose to call and speak with a Medicare agent or do the research yourself on their website you will need several things:

- A list of your current prescriptions, along with the dosage and frequency information. If possible, simply have your prescription bottles in front of you.

- A pen and paper .

- A cup of coffee (optional but recommended)

The phone call or website research will take anywhere from 15-45 minutes depending on how many prescriptions you are taking. If you do your own research on the web, you will have the option of saving the information you enter for later.

What Information will you receive in reviewing your Medicare Prescription Plan?

After you (or the Medicare Agent) finishes entering your prescriptions into the Medicare Prescription Plan system, you will be presented with a list of Medicare Prescription Plans available in your county. By default the plans will be sorted in order of “Lowest Total Annual Expense” to “Greatest Total Annual Expense.” The total expense shown for each plan includes plan premiums, deductibles (if any), co-pays, and any other costs that you may incur over the course of the year.

So, Should you Change your Medicare Prescription Plan?

Now we have the information to answer your first question, “Should you change your Medicare Prescription (Part-D) Plan? In general, you should see the plan that you currently have in the list of plans presented by the website or by the Medicare Agent. If your plan is not the first one listed (i.e. It does not offer the lowest total annual expense to you, then you should consider changing plans.

First, you should compare the total expense of your current plan and top 1 or 2 plans listed. If the differences is only a few dollars then you may decide it’s not worth the trouble of completing an application, getting new cards, etc. If however, the difference is hundreds of dollars (which is not uncommon), then you should definitely consider changing your plan for the following year.

What’s Involved in Changing Medicare Prescription Plans?

Once you have completed the evaluation of available plans and their associated expenses, you have done 90% of the work. If you want to change plans, you simply tell the Agent that you would like to change, or you follow the instructions on the website. A few weeks later you will receive a new Prescription Card in the mail that you will begin using January 1st of the next year. (Don’t swap your prescription cards in your wallet until January 1st. Your current cards is still valid through December 31st of this year)

Significant Differences in Total Annual Expense of Medicare Prescription Plans

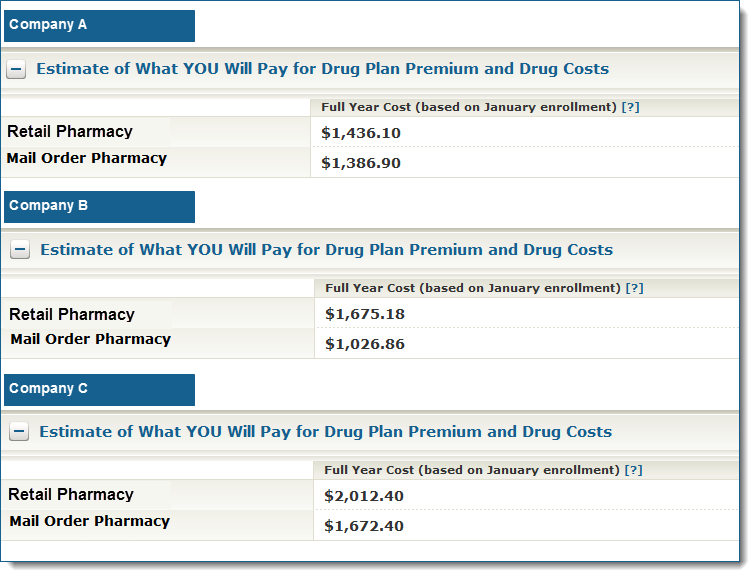

Below I have included data for three plans (I’ll call them Plan A, B, and C) that were available for the 2013 calendar year. I entered four common prescriptions along with typical dosage and frequencies. There are several things I want you to notice.

Note Number 1

The reason I’m using “Company A, B, and C” is because although Company A was the least expensive for these prescriptions in this state and county, Company A may very likely be the highest Plan for four different prescriptions in a different state and county. It ALL depends on your specific prescriptions. That is why I am not listing specific Companies. I don’t want you to think that one plan is better than others, because that is definitely NOT the case.

Note Number 2

Big differences between Lowest and Highest expenses Medicare Prescription Costs at a Retail Pharmacy Company A’s annual expense when using a retail pharmacy was $1,436.10 Company B’s annual expense using the same pharmacy was $1,675.18 Company C’s annual expense using the same pharmacy was $2,012.40 The difference between the lowest Plan A and the highest Plan C is $576.30

Remember, you are getting the “Exact” same prescriptions from the “Exact” same pharmacy, but your total out of pocket expenses over the year are $576.30 less with Company A.

Note Number 3

Don’t forget Mail Order You may be surprised to see that you could reduce your expenses from $2,012.40 down to $1,436.10 by simply changing Part-D Companies from A to C. But take a look at Company B. Although their total expense using a Retail store is $1,675.18, that drops to $1,026.86 if you use their mail order option. Now we are looking at a $985.54 savings. And it only cost a 30 minute phone call with Medicare. How many other things can you do next year to save $1,000 dollars on your healthcare costs?

Conclusion

If you have a Medicare Advantage Plan, your prescriptions may be included (they typically are.) However, if you have a traditional Medicare Supplement and a stand-alone Medicare Prescription Plan, it is definitely worth the time to review your prescription plan each year.

{ 0 comments… add one now }